audit vs tax vs advisory

I have been given the opportunity to chose Tax or Advisory at Public Accounting firm. Advisory is supposedly seen as more prestigious than audit because its more quantitative and analytical their words not mine.

Tax Vs Audit A Q A With Bs In Accounting Program Director John Barden Naveen Jindal School Of Management The University Of Texas At Dallas

Its called a learning experience you learn from it and you move on to something better.

. The people I know in Advisory have their CFA and they all. Deciding whether to specialize in tax or audit is a choice that college accounting majors need to make. Tax and audit roles offer little creativity mostly they just do boring regulatory work and paperwork.

Have some free slabs of time available. I cant really be bothered to. Tax and audit groups work very long hours and get paid less than advisory.

Primarily includes the Financial Statement Audits. Diversified industry experience to sell. Exposure to a wider range of industry financial reporting.

Where as auditors work in teams. Business Tax Compliance or Business Tax Advisory for Clients Withholding Tax. Its free to sign up and bid on jobs.

Auditors work with clients from day one where. Search for jobs related to Audit vs tax vs advisory or hire on the worlds largest freelancing marketplace with 20m jobs. I personally find advisory work much more interesting.

Tax pays better but kind of pigeon. Big 4 Audit Vs. Advisory careers with a company like KPMG can.

Getting into the big 4 especially in audit can make for a very promising career. From what I have been told Advisory pays more tends to be more interesting has better exit opportunities. Consulting is highest paying and probably most interesting depending on the specific type.

Each discipline within the profession sees itself as the best part of the profession. In the context of Big4s Assurance. Big 4 Audit Vs.

Audit vs Tax Vs Advisory - - - - - - - - - - - -Audit- - - - - - - - - - - - Advantages. Audit is lowest paying but is a solidstable path to a good career. Audit is only long during busy season Tax is usually clock work 9-5 and Advisory will depends on the deal during peak time youll be pulling long hours banker hours.

Lets dive into the pros and the cons of deciding between tax vs. Here are some of the differences between both options. Have an opportunity to learn more in less time.

Whichever discipline you choose is how you will define your career. There is friendly rivalry. Answer 1 of 5.

You are not tied down to only working in tax or only working in audit your entire career. Multiple clients in less time. The salary range for some of the largest employers include PricewaterhouseCoopers 40863-56951 Ernst and Young LLP 44644 to 72000 and Deloitte Tax LLP 48322 to 104296.

Tax accountants typically work individually.

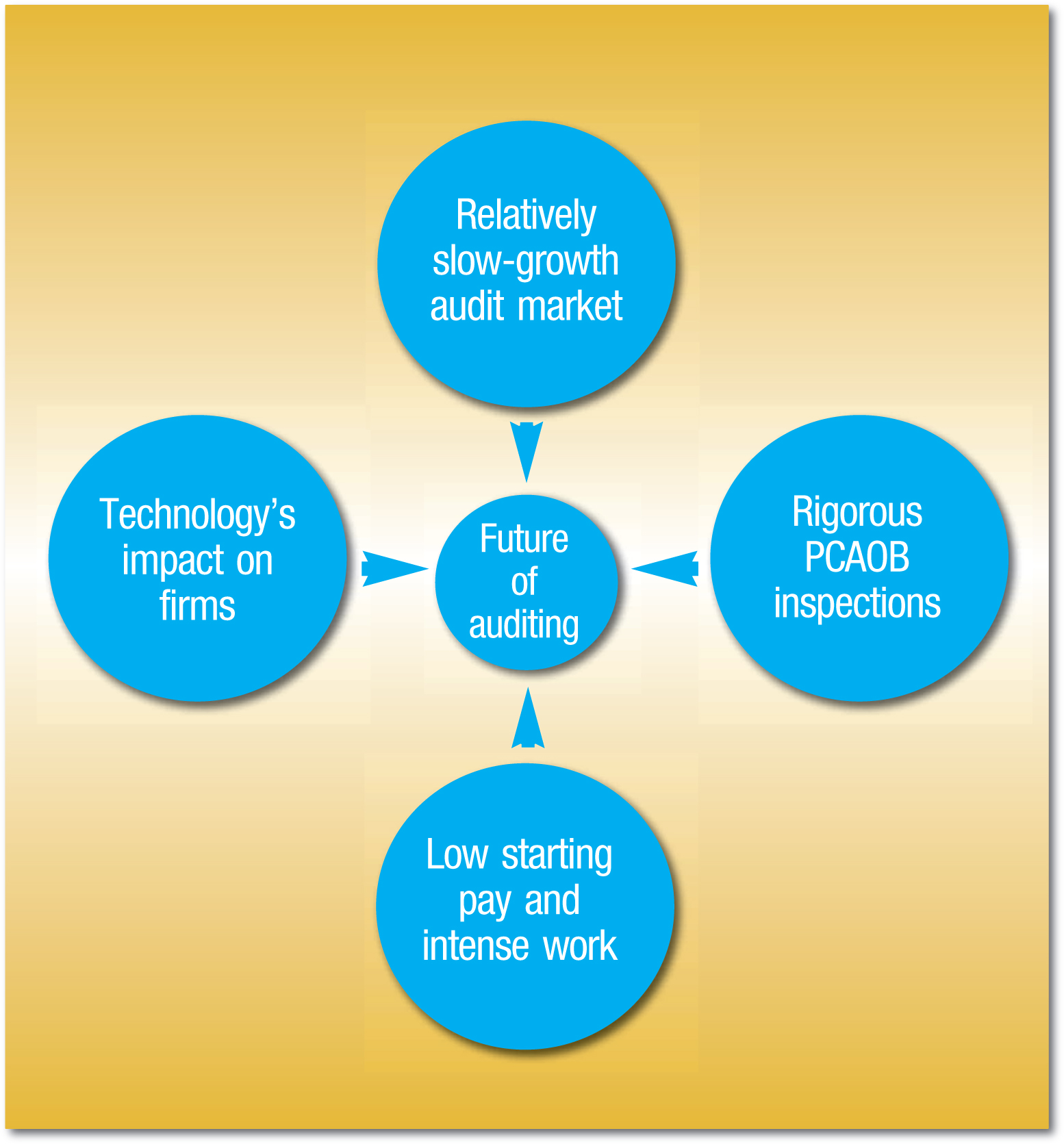

Where Is Public Company Auditing Headed The Cpa Journal

Microsoft Dynamics 365 For Audit Tax And Advisory Services

Why We Don T Do Taxes Audits Or Strategic Advisory Services

Big 4 Accounting Firms Salary 2022 Which Has The Best Cpa Salary

Present To Win For A Leading Organization Of Independent Audit And Tax Advisory Lsa Global

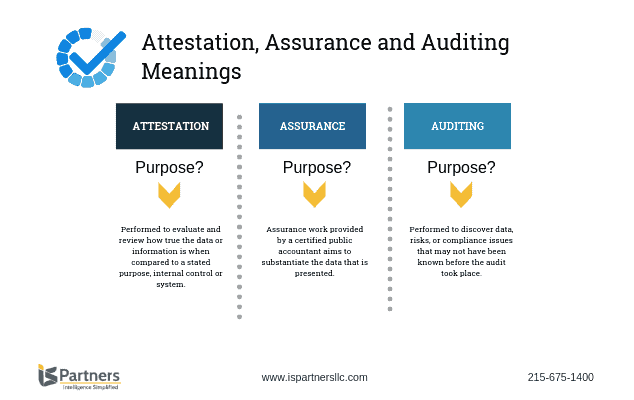

Audit Vs Assurance Top 5 Best Differences With Infographics

Usa New York City Manhattan Time Square At Broadway Skyscraper Office Tower Ernst Young Ey E Y Multinational Company Provides Assurance Financial Audit Tax Consulting And Advisory Services Stock Photo Alamy

Big Four Revenue By Function 2021 Statista

Tax Versus Audit Versus Advisory Services Where To Take Your Business

Defining Attestation Auditing Assurance I S Partners Llc

Deloitte Ey Kpmc And Pwc Everything You Need To Know About The Big Four Consultants

Accounting Firm For Tax Audit Advisory Services Windes

Mergers Acquisitions M A Advisory

The Financial Statement Auditing Environment Ppt Download

Cg Tax Audit Advisory Are You Subscribed To The Cg Business Advisor Podcast New Episode Is Dropping Soon Listen Here Https Bit Ly 3lbtcy6 Facebook

Accounting Firm For Tax Audit Advisory Services Windes

Audit Vs Tax The Accounting Major S Major Decision

How I Chose Tax Vs Audit Kreischer Miller

California Cpa Corner Tax Audit Advisory Irvine Orange County Los Angeles