how to reduce taxable income for high earners australia

Of those millionaires 15303 paid an average of 44 tax on their 3508bn total taxable income. Therefore the plan is for you to forego some of your pre-tax earnings before you receive them.

Income Tax In Germany For Expat Employees Expatica

Those who are high-income should consider donating low-cost stock contributing to an individual advised fund or stacking future charitable donations year after year to simplify their tax deductionsSpending on mortgages is a major expense.

. Take Home Rates for an annual income of 400000. If youre a high-income earner in Australia it is wise to implement a tax minimization strategy. Sometimes it doesnt need much to move down a tax bracket.

Your annual tax payable can be reduced by pre-paying some of your tax-deductible expenses such as prepaying the interest on an investment loan. Even though one of the smartest minds of our history cannot understand a tax on income income tax has proven over time to be an effective means of raising funds to fuel our standard of living worldwide. According to an analysis of countries around the world by Price Waterhouse Cooper Australia is ranked nearly at the top of tax rates for high-income earners.

Grab a 0 tax rate on gains. You are taxed at a higher rate once you earn more than the threshold of each bracket. Reducing your capital gains tax CGT liability.

The latter figure is far smaller averaging 15 percent for most persons. People in the 10 and 15 brackets including joint filers with less than 75900 in income and singles under 37950 pay no tax on long-term capital gains. Tax deduction versus tax offset The ATO considers some expenses as valid ways to reduce tax payable however how and when the reduction is applied on the assessable income depends on the type of expense.

At some point there will be tax consequences associated with the distribution of the assets. Maximizing all of your allowable tax deductions Maximizing your tax offsets Reducing your capital gains tax CGT liability Buying assets in your partners name 2. Salary sacrificing super Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead.

How do high-income earners reduce taxes in Australia. How Can Personal Taxable Income Be Reduced. Taxable income falls into five tax brackets.

Salary sacrificing Personal deductible contributions There is no income tax limit on salary sacrifices. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. The other 55 paid nothing.

If your total income was 88000 and you made more than 1000 in deductions you would move down to a lower tax bracket. You can reduce the amount of taxable income you pay by investing in an employer-sponsored retirement plan or an individual retirement plan. High-income earners can take advantage of the various tax deductions or offsets that the Australian Taxation Office ATO permits.

Lets say you have a 35 interest rate on your 750000 mortgage. How Do High Income Earners Reduce Taxes. If you can manage your taxable income by fully maximising your tax deductions or deferring income to a future year you may be eligible for tax offsets ranging up to 1080 to help reduce your tax liability.

Self-employed taxpayers or unsupported taxpayers can make contributions to their supers and also claim a full tax deduction. The higher your income tax bracket the more beneficial this itemization is for you. Youd have to contribute 5000 of money into super but it would save you 2350 in tax by doing so if you were paying 49 tax on your salary.

Acquire Private Medical Insurance. During the years in which contributions to health insurance flexible spending accounts as well as health spending accounts help reduce taxable income. Every country around the world pays tax.

1 day agoThis would prevent high-income earners from using lots of deductions to avoid paying tax The average taxable income for Australians rose. By making a salary sacrifice you can reduce the amount of tax that you pay on both your income and your contributions to your superannuation. Comparison of taxes in Australia Vs OECD.

If you can pay some of your expenses in advance you wont have to worry about paying them the next year and you can claim them as a tax deduction in the current year. What Decreases Your Taxable Income. That is approximately 26000 of mortgage interest in the first year.

To reduce your taxes you can make the following concessionary contributions. Superannuation contribution options to reduce taxes. If thats you be ready to sell some winning funds later in the year even if.

Your mortgage interest on a loan up to 750000 is a line item for itemizing deductions. A common offset is the Low Income Tax Offset and the Low and Middle Income Tax Offset. 12 Tax Gain Harvesting Many people dont realize this but below a taxable income of 40400 80800 married you dont pay taxes on long term capital gains.

Always talk to a good Financial Adviser to make sure this is appropriate for your situation. Tax-deferred investment vehicles arent the same as tax-exempt such as a Roth IRA or HSA accounts. You are just taking advantage of some price fluctuations to lower your tax bill.

If you made 400000 this year nobody is happier than those guys at the ATO where youre going to pay 164000 at the very least. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia.

Finance Economics The Economist

Non Refundable Tax Credit Overview How It Works Example

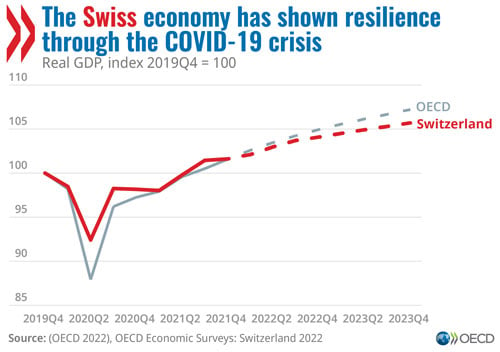

Switzerland Reviving Productivity Growth And Improving Labour Market Participation Key For Sustained Recovery From Covid 19 Says Oecd

The Fed Monetary Policy Monetary Policy Report

Security Awareness Training A Business Critical Function For The Logistics And Transportation Industries

Does It Still Make Sense To Put Down 20 When Buying A Home Cnn Underscored

![]()

Security Awareness Training A Business Critical Function For The Logistics And Transportation Industries

What Governments Can Do To Curb Inequality

Why Getting A Large Tax Refund Is Bad Gobankingrates

Finance Economics The Economist

Finance Economics The Economist

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute