tax break refund calculator

It means that 765 of your income is withheld. No More Guessing On Your Tax Refund.

Tax Return Calculator 2012 Tax Calculator 2012

Piper established an example to explain refunds in an extremely simple.

. Tax preparation software has been updated to. For your convenience current Boydton mortgage rates are published below. So our calculation looks something like this.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The Medicare tax calculates 145 of your earnings. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Taxes Made Simple Again. Use this free tax return calculator to estimate how much youll owe in federal taxes using your income deductions and credits in just a few steps. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

There are multiple tax breaks for parents including the child tax credit. Prepare federal and state income taxes online. Ad Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund.

Up to 35 cash back Our tax refund calculator will do the work for you. Youll fill out basic personal and family information to determine your filing status and claim any dependents. Tax refund time frames will vary.

Itemized Deductions the. An Income-tax calculator is an online tool that helps to evaluate taxes based on a persons income once the Union Budget for the year is announced. Just enter some basic information about yourselfand its fine to guesstimate.

This calculator will help you to estimate the tax benefits of buying a home versus renting. By filling in the relevant information you can estimate how large a refund you. Preparing Them Shouldnt Be.

Up to 10 cash back Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and. E-File your tax return directly to the IRS. Information for people who havent filed their 2020 tax return.

Taxes Are Complicated Enough. 10200 x 2 x 012 2448. Estimate your tax refund or simply practice your taxes with our free tax calculator.

If you have yet to file your 2020 tax return you can claim the tax break up to 10200 from your taxable income. Not Only Get Your Refund But Many Other Answers. Ad Free tax filing for simple and complex returns.

Ad Use one of the 10 Online Tax Calculators. To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break. Individuals falling under the taxable income.

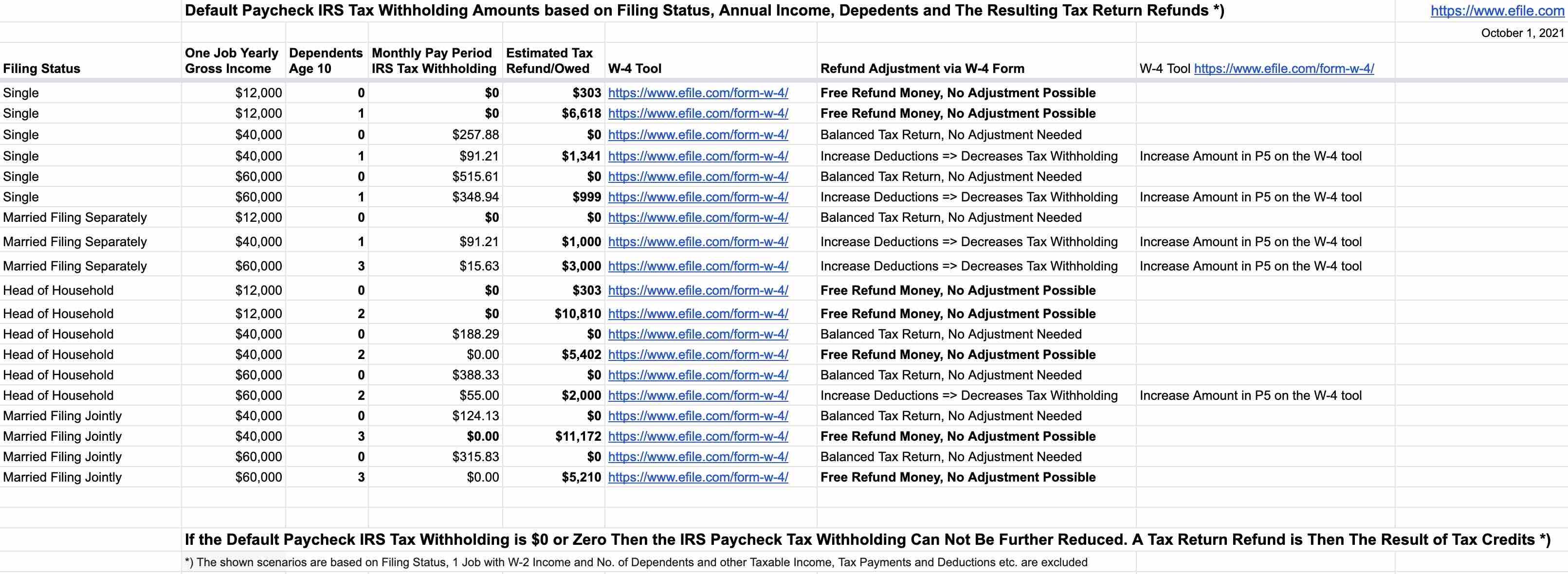

Fastest tax refund with e-file and direct deposit. These taxpayers may want to review their state tax returns as well. Its a self-service tool you can use to complete or adjust your Form W-4 or.

Estimate Today With The TurboTax Free Calculator. How To Apply For Va Individual. Ad Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund.

The IRS issues more than 9 out of 10 refunds in less than 21 days. Guaranteed maximum tax refund. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you.

Up to 1400 of that amount is. This handy online tax refund calculator provides a simplified version of the IRS 1040 tax form. For 2020 the child tax credit is worth a maximum of 2000 per qualifying child.

Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund. Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund.

Tax Calculator Estimate Your Taxes And Refund For Free

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Estimate Your Tax Refund With The Turbotax Taxcaster The Turbotax Blog

Excel Formula Income Tax Bracket Calculation Exceljet

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor